By Rick VanSickle

It’s become perfectly clear that seismic changes are on the horizon for wine retailing in Ontario. What isn’t so crystal clear is who will benefit — and who will not — from those changes.

As Sue-Ann Staff (above), proprietor at Niagara’s Sue-Ann Staff Estate Winery, said, she has an “excited-fear” of the impending changes. “This is something we have waited a lifetime for. The change is necessary, which is exciting. At the same time, it has to be done with thought and the appropriate safeguards.”

Staff isn’t alone with that mix of fear and excitement, it’s a sentiment felt throughout the Ontario wine industry — big and small — as the Ford government readies itself to announce wide-sweeping changes to how consumers buy booze in Ontario and how local wineries, breweries, cideries etc. can sell their products without relying entirely on the LCBO and without paying crippling taxes and levies they are now forced to cough up.

The only thing we really know at this point (and it’s been reported by the Toronto Star and now CBC, and earlier by this website, all from sources) is the horribly unfair deal The Beer Store has had since 1927 in Ontario is about to come to an end. It’s expected that The Beer Store will be given notice by the end of December under the Master Framework Agreement (MFA) that the deal will be all but dead. They will have two years to wrap things up while a more modern system of booze retailing is fine-tuned and prepared for implementation. There’s a new era dawning in Ontario, one that would seemingly benefit grocery and convenience stores, local brewers, Ontario wineries, and obviously consumers who will get wider selection, more convenience and competitive pricing.

“The MFA has never been about choice, convenience or prices for customers, it has always been about serving the interests of the big brewing conglomerates, and that’s what needs to be addressed,” Michelle Wasylyshen, spokesperson for the Retail Council of Canada, whose board of directors includes members from Loblaw, Sobeys, Metro, Walmart, and Costco, told Mike Crawley of the CBC.

The end of The Beer Store MFA in whatever iteration it will look like will have a cascading impact on local VQA wine. Ontario wineries hope that it’s a positive impact and are cautiously optimistic that wide open beer and wine sales at grocery and convenience stores means more sales and less levies for their products.

As the CBC pointed out in its story, the looming reforms “pit a range of interests against each other, as big supermarket companies, convenience store chains, the giant beer and wine producers, craft brewers and small wineries all vie for the best deal possible when Ontario’s almost $10-billion-a-year retail landscape shifts. And — this is a biggie — the LCBO lobbying efforts to keep its antiquated system of monopoly retailing intact, which seems to be a big ask with what we now know from sources. Something must give.

Some key bullet points from the CBC report:

• Will the government shrink the LCBO’s profit margins, including its take from products that other retailers sell?

• Will retailers such as grocery and convenience stores be required to devote a certain amount of shelf space to Ontario-made beer and wine, or will they have total control over the inventory they stock?

• Will small Ontario wineries get any help in competing against big Ontario wineries whose products can contain as much as 75% imported wine?

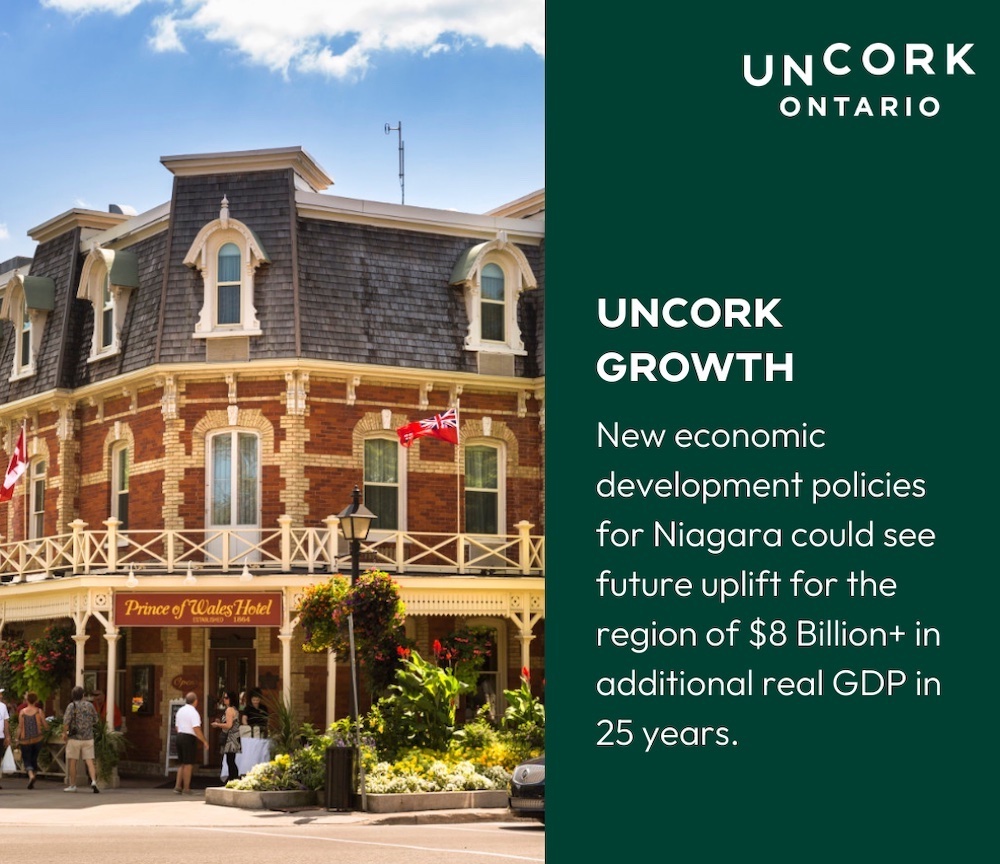

The government has been listening to all stakeholders in the booze industry in Ontario for over a year now. Three key associations — Ontario Craft Wineries, Tourism Partnership Niagara, and Wine Growers Ontario — joined together to commission a report titled Uncork Ontario. That report, which concludes that the Ontario wine sector is well positioned to drive sustainable economic growth for the region, the province, and the country and has the potential to drive at least $8 billion in additional real GDP over the next 25 years, launched a campaign to lobby the government for radical changes to reach those lofty goals, or at least put the wheels in motion.

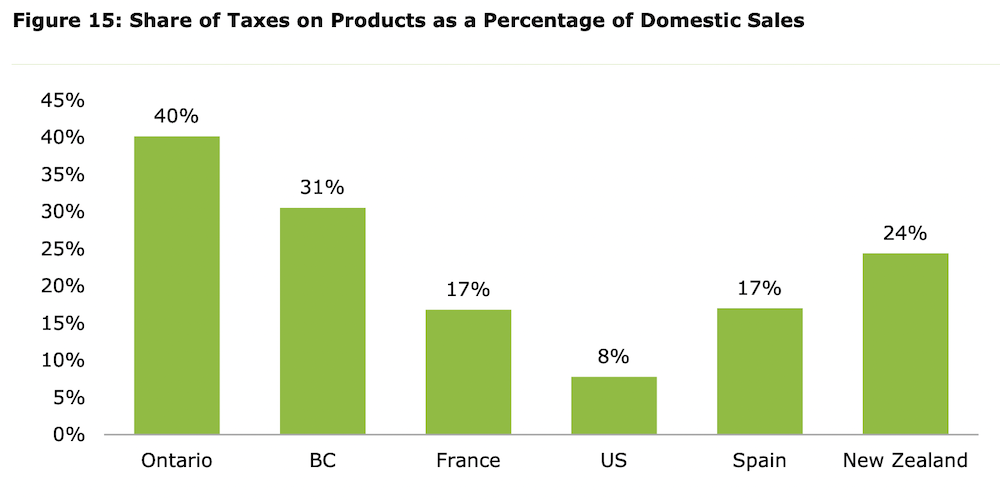

One of the big issues for Ontario wineries is a punishing 6.1% “sin” tax charged on every wine made in Ontario but not foreign wines. It’s a tax that’s been hurting Ontario wineries for years even though a grant was issued to wineries to help pay that tax back. To this date, the tax has not been cancelled and wineries keep remitting the tax owed monthly and can only hope the grant keeps getting extended. Ontario wines are among the highest taxed in the world with up to 73% of every bottle sold going to taxes and severe levies at the LCBO.

While that 6.1% tax is an immediate concern, an overhaul of the alcohol beverage industry is likely a larger concern, and of more importance for the future of the industry. Premier Doug Ford has always signalled that he is a big believer in opening the industry to a broader range of retail options for consumers beyond the LCBO and the system now in place at grocery stores. With the end near for The Beer Store and a broader more equitable retailing system in grocery and convenience stores (for now), there will be big winners and big losers — not all interests will get what they want. In terms of wine in Ontario, not everyone in the industry is on exactly the same page.

Obviously, there is concern that under a new retail plan, large grocery chains will have freedom over what they stock on their shelves and that could result in Ontario wineries being passed over for cheap, mass-produced international products and/or blended IDB wines from the large Canadian wine companies permitted to blend 75% foreign grapes with 25% Ontario grapes.

“Retail expansion must be done right or else it threatens the future of Ontario wine and further supports heavily subsidized, foreign wineries,” said the Uncork Ontario report.

Sue-Ann Staff has some thoughts beyond the Uncork Ontario report for what the Ford government should do to put local wines on an even playing field with the big international wine companies and the large Ontario wine companies such as Arterra and Peller, with hundreds of its own private stores.

Here is what Staff would like to see considered:

• A healthy-sized space carved out of each new retail spaced dedicated solely to small wineries allowing the tiniest chance to catch up from decades of inequities in the marketplace;

• Exclusion of private labelled wines, assuming someone like Costco, who would likely create a value-oriented Kirkland brand, would be able to dominate and it would be a race to the bottom. Private labelled wines could happen with time; however, small producers need at least 10 to 15 years before they are ready to compete with wines branded like this;

• Appropriate taxation on wines sold at retail with differing taxation levels based on content (ie: taxation similar to the licensee sales model, hence VQA wines would be taxed at a lower rate than IDB wines. In fact, IDB wines, which have received decades of preferential market access, should not be permitted into any new sales channels. They already have their own 264 stores;

• An ability to direct deliver wines at wholesale prices directly to any new sales channels. Currently, wines sold in supermarkets are distributed by the LCBO. This middleman is completely unnecessary and should be eliminated. Selling wine directly at FOB/wholesale pricing would provide better margins to both the retailer and the producer.

Staff points to several examples of retail models that work in North American, such as New York state, where a retailer cannot own more than three locations ensuring no market dominance by any retailer, Manitoba and Nova Scotia where private stores co-exist with government owned and managed stores, British Columbia where private and government retail stores co-exist with the addition of 19 VQA-only stores, and Alberta where the government only manages warehousing of products coming into and out of the province and the products are taxed at the warehouse then transported to private retailers for sales.

Staff said that the current state of beverage alcohol in Ontario is “likely the most uninspired alcohol retail (system) in North America. We have a low selection of products in relation to other major global retailers with a limited number of locations to purchase it. These locations are not dynamic retail locations in comparison to other alcohol retailers globally or in comparison to other store types (clothing, cars, grocery, etc.), she said. “It’s the result of decades of protecting a multitude of monopolies including the LCBO, The Beer Store and the 264 wineshops owned exclusively by two of my competitors. Why do they need corporate protection? Why can they not compete with the private sector? If they are not prepared for competition, then when will they be? When the Master Framework sunsets in early 2026, they (LCBO and Beer Store) will have had 99 years to prepare for competition. Ninety-nine years.”

The CBC pointed out that while Ontario’s current regulations limit who can sell alcohol as a retailer, and in what formats, the limits on the biggest players in the industry are far less strict than what small breweries and wineries face.

• The Beer Store has 424 locations around Ontario. It is majority-owned by two brewing multinationals: Molson Coors and Anheuser-Busch InBev (owner of Labatt). Its latest financial statements show $450 million in annual revenue.

• The Wine Rack has 164 locations. It is part of Arterra Wines Canada, the company that owns such wineries as Jackson-Triggs, Inniskillin and Sandbanks.

• The Wine Shop (100 locations) is part of Andrew Peller Ltd., the company that owns such wineries as Peller Estates, Trius, and Wayne Gretzky Estates.

By contrast, each craft brewery can only have two retail outlets, and both must be attached to a production facility. Each small winery can only have one retail outlet, located where it grows grapes and makes wine. Both the craft beer and small winery sectors want those restrictions scrapped, according to the CBC report.

Southbrook Vineyard owner Bill Redelmeier, below, has never held back on the modernization of wine retailing and isn’t about to now.

“I need access to my home market,” he told Wines in Niagara. “As a small winery, a grape grower, a farmer, and someone who is trying to preserve farmland as a good for the province, that is what I need. I am worried that as (Premier Doug) Ford listens to all of the competing voices he will make mistakes, and once offered, promises can never be withdrawn. To avoid mistakes, I would suggest starting with a model. I would suggest that Alberta might be the one.”

Redelmeier said that 30 years ago, the ALCB (Alberta Liquor Control Board at the time) looked very similar to the LCBO. “They were privatized after an unpleasant strike. They divested themselves of warehousing, shipping, and buying, leaving themselves as only gatekeepers and fee collectors. They originally tried to limit the number of licenses held by one entity but that was quashed in court.” He explained that the money collected by the board is in two pieces: there is a flat tax on alcohol, to cover social costs, and a markup of around 6.5% to cover income to the province. If you are a small producer internationally, the flat tax is significantly reduced for beer and spirits (not wine: no wineries in Alberta) which favours local producers.

“This means that all of the buyers, big and small, pay the same, which means that small shops can compete, and the small store is where we want to play,” Redelmeier said.

As for The Beer Store, Redelmeier said it should play an important role in the re-use of bottles. “Refilling bottles is one of the keys to sustainability, but how to maintain it will remain to be seen.”

Many stakeholders contacted for this story cited Non-Disclosure Agreements, and couldn’t comment as they have sat in on meetings over the last few months discussing what the new landscape for wine retailing might look like.

Richard Linley, president at Ontario Craft Wineries, while not revealing any information from the discussions, had this to say about the future of wine retailing in Ontario from association members’ point of view.

“Our VQA wine industry should be a major source of pride, employment, and investment in Ontario in a new environment that is not stifled by the current situation of over-taxation and poor regulations. The only win for our sector is one where the Ontario government stands behind us and recognizes the importance of not only sustaining, but growing, our agricultural businesses for generations to come. We believe that the Ontario government has heard, understands, and supports this message. This government has an opportunity to correct the historical policy errors of previous governments and doing so would chart a new path for Ontario’s wineries, grape growers and a host of other stakeholders that indirectly benefit from our success.”

Matthias Oppenlaender (above), chair of the Grape Growers of Ontario, a major grape grower in Niagara-on-the-Lake and more recently with his family, started the Liebling Wines, had this to say:

“The modernization review that is currently underway in Ontario is one of the most important and fundamental changes for our industry and the Ontario consumer. If done right, this will create a sustainable future for our farm families that grow 100% Ontario grown VQA wines and will have a positive effect on our local economies.”

It is a huge undertaking modernizing alcohol in Ontario and the elimination of The Beer Store is just the beginning.

No one from Wine Growers Ontario, which represents the large wine companies including Arterra and Peller, was willing to comment, citing NDAs.

Where does the LCBO fit into the puzzle? It’s one of the most antiquated monopolies on the planet, created in 1927 out of the ashes of Prohibition and has changed little in its nearly 100-year history. Only a fraction of small to medium Ontario wineries can even get on the shelves of LCBO stores and when they do, they get roughly 30 to 45% of the sticker price, according to industry officials who spoke to the CBC. The LCBO’s own price calculators show it puts a 114% retail markup on Ontario wine. One example shows wine supplied by a producer at $8.33 per bottle retailing for $22.30, once the markup, government levies and HST are added in. You can see why small producers don’t even consider the LCBO a viable retail choice.

Wines in Niagara interviewed Grape Growers of Ontario CEO Debbie Zimmerman (below) recently. She said the problems and the solutions are complicated and there are no easy fixes. The Ontario wine industry is at a crossroads, with declining sales, changing consumer habits and the expanding zero-alcohol market, and upcoming decisions being made at Queen’s Park by the Ford government is the wild card that will either help or hinder growth for grape growers and estate wineries.

“The future seems uncertain,” said a frustrated Zimmerman. She pointed to market share at the LCBO stuck, and actually falling, at 7.3% for Ontario VQA wines, with the number only rising to 12.1% overall for all VQA wine sales. The rest of the market is imports at 55.6% and IDB (International Domestic Blends, which can contain as little as 25% Ontario grapes) wines at 32.3%.

For his part, Del Rollo, VP of corporate affairs at Arterra Wines, wrote in a LinkedIn post recently that many challenges face the Ontario wine industry.

“We have the potential to really grow and continue to be a key economic contributor to Canada and the provinces,” he wrote. “There are many challenges for us, climate change, short corps, surpluses, economic uncertainty due to wars, Covid and other issues, but there is one area that should be under our control as a country and that is how the government treats our industry via taxation and supports.”

He pointed out that the domestic wine industry pays approximately $2.2 billion in taxes and markups per year, which translates to about 73% of every bottle of wine sold is taxes and fees. “There is no doubt that our industry is vital to the provinces and the federal government to help subsidize the expenses of the government for healthcare, infrastructure, education and many other important needs of the public,” he wrote. “The challenge is governments have gone too far and the industry is at a tipping point. The annual excise tax escalator that goes up every year and other markups and taxes that continue to increase are making this business unsustainable. This is obviously concerning for our industry as it is becoming increasingly hard to compete with highly subsidized foreign imports, but it is also concerning, because another increase in tax could actually tip the scales and cause businesses to fail, and the rich pool of taxes that the government relies on will shrink, as opposed to grow. The better investment is to provide certainty for our businesses so that we continue to grow. Stop increasing our taxes and provide support for our industry. With growth of our industry, comes an increased tax base and it is a win-win.”

Rollo hopes “that the governments really think long and hard about this and make the right decisions. Choose growth and certainty, rather than the opposite. We are poised to grow and ready to invest if we have certainty. This strategy will pay off for all parties involved. More Jobs, more grapes purchased, more tourism, more economic activity in key regions and a stable and growing tax base…. not because of increased tax rates, but because of growth of the sector.”

The worst part of this is the LCBO has done nothing to change consumer perception for Ontario VQA wine. Here we are winning raves in Decanter magazine, at international wine competitions and the average consumer associates Ontario wine with boxed plonk or too-sweet cheap and cheery that’s been mixed with Australian juice that sells for $0.25/litre. What a disservice this regime has done us. What I’d like in the meantime is a little truth in advertising at the LCBO. How about a sign over some of the imports that says “subsidized export to unfairly compete with local” or “made profitably through the use of illegal (or slave in some cases) poorly-paid labour” or even “lovingly made with 200 chemical additives to ensure we could still use those yucky grapes”? Unfortunately, Doug Ford doesn’t have a great track record on doing what’s right for small business or agriculture. I don’t expect this will turn out to the benefit of small and medium wineries. The production, marketing and sale of really good Ontario VQA wines will remain in the hands of the passionate and tenacious. I bet we end up with Kirkland Ontario, lots of angry union members and continued frustration for the producers of Ontario world class wine.

If this come to an end, and the Ontario government would admit at one point that for decades charged the domestic wine producers higher taxes than international producers, the situation could get worse.

We can see court cases where Ontario wineries could ask retroactive tax return (decades for some) for unfair taxations. Could be an interesting future case studies for law schools.

Excellent article Rick, thanks for writing this. It will be interesting to see how this unfolds, can’t wait for the movie!

Thanks, Tonia!

The apparently excessive taxation of Ontario VQA wines that you describe should definitely be rectified. The IDB wines should be banned so that Ontario wineries should be producing wines from only Canadian grapes. I believe that the LCBO currently markets an excellent cross section of the world’s wines. Over the years the LCBO has developed and changed incredibly from the days in the 1960’s when you had to buy from a catalogue and carry your bottle directly home in a brown paper bag. In my travels I have found very few retail operations that can match the LCBO’s selection, I hope we do not lose it. The Alberta LCB used to match Ontario’s, however now choice in that province is much more restrictive in that profit only province.

Leave the LCBO alone!