By Carolyn Hurst

Chair of Ontario Craft Wineries

How to write a year in review in an industry as complicated as the Ontario wine industry? Where to begin the story?

• 93 years ago at the end of Prohibition?

• 30 years ago with the NAFTA agreement?

• 20 years ago with the amendment of the Wine Content Act?

• 20 years ago with the creation of the VQA Act?

• 10 years ago and the Ed Clark Alcohol Sector Review for the Wynne Government?

• The Ford government arrival to Queen’s Park?

• The Ken Hughes Report on the Ontario Alcohol Sector presented to then Minister of Finance Vic Fedeli.

How about January 1, 2020?

What is past is prologue

Every problem, challenge or impediment to the growth in our industry is caused by a complicated web of past government decisions, regulations and legislation. And at the heart of all this complexity is the collection of tax revenue. There has never been an Ontario government view of our industry as an economic growth sector or a cultural jewel. The Ontario Ministry of Finance holds all the cards and therefore, for almost 100 years the Provincial government has regarded the Ontario wine industry as nothing more than a tax opportunity.

We cannot change the future of our industry without changing public and government perspective of our economic and cultural impact and the opportunities for growth.

The Ontario Craft Wineries (OCW) association started January 2020 much as we started 2019 and 2018 – with hope for change. We travelled to Queen’s Park to meet with politicians and bureaucrats, explaining and fighting for change to our archaic regulatory and tax system.

Our ask and message was and is simple:

• Stop Import Taxing VQA/100% Ontario Grown Wines – VQA wine sales through wholesale channels like the LCBO and Grocery

• Eliminate the 6.1% Wine Basic Tax (an additional sales tax) that is collected from small wineries on farm gate sales.

• Unleash the entrepreneurial opportunities for growth of small businesses in the wine industry.

The 2019 Deloitte Wine Industry Survey highlighted that 48% of Ontario Craft Wineries were losing money and were not economically sustainable. Winery owners were going deeper into debt in order to pay their special provincial wine taxes. The government takes their tax first and “off the top” while the small winery owners sink further into debt – their dreams fading.

The elimination of the 6.1% farm gate surtax would bring 45 wineries from not profitable to break even or a small profit. This is so simple to fix. Just eliminate the tax. Just do it. No other industry is taxed like this — in Ontario or anywhere in the world.

As we entered 2020, we were encouraged by the consultations that resulted in the Ken Hughes report presented to Minister Fedeli in May 2019: The Case for Change: Increasing Choice and Expanding Opportunity in Ontario’s Alcohol Sector.

Ken Hughes:

“Ontario has a once in a generation opportunity to make meaningful change that will allow small businesses to flourish and create jobs while providing choice and convenience for the purchase of beverage alcohol.

“Over the past 92 years, successive governments have incrementally allowed rules, loopholes, institutions, and special interests develop a near-monopoly distribution system that primarily benefits a few larger companies.”

However, the budget came and went with no material changes for our industry. The report was put on a shelf and we never heard anything more about it. And then we had a new minister of finance, Rod Phillips, and his staff to brief and start all over again. Groundhog Day.

In Spring 2020 we faced a WTO Australian Trade Challenge. Federal Excise tax escalation was the trigger for the federal level trade challenge but the Provincial Liquor Monopolies and their practices where at the heart of the issue. Australian wines enjoy significant bulk wine and retail wine market share of more than 25% in Canada. Ontario VQA has less than 10% market share in our Ontario market and less in the Canadian market as a whole. Canada does not have any real wine sales in Australia – less than 1% market share. This is an outrageous attack by a “friend.”

Australia provides agricultural subsidies to wine growers and dumps bulk wine into the Ontario marketplace at price levels below production costs. This wine ends up on the shelves of the LCBO as a component of IDB wines or as cheap Australian “critter wines” in bottles. Ontario Craft Wineries were collateral damage in a clash between big politically connected incumbents. Our government gave us no protection.

The outcome of a federal negotiation on this challenge is that starting in 2022 every small winery in Ontario will have to pay a federal excise tax on every litre of wine they produce. This tax cannot be passed on to the consumer via a price increase. This will quite simply put most of the small wineries in Ontario out of business.

In December 2020, U.S. lawmakers passed a bill which provides a full excise refund to all small wineries in America. The EU approved hundreds of millions of Euros in funding to support the marketing efforts of EU wine producers. There is no wine region in the world that treats its domestic wine grower/producers as badly as Ontario and Canada does.

A case study of the growth of

the Oregon industry versus

Ontario from 1970 to today

In 1970 the total land under grapevine in Ontario was 14,000 acres (mostly Concord, Labrusca and hybrids) and there were 6 wineries in the Province. Common wisdom was that higher value vinifera grapes could not be consistently grown in Ontario due to harsh winters and a short growing season. In 1978 and 1979 brave Ontario winemakers: Karl Kaiser, Donald Ziraldo, Paul Bosc in Niagara-on-the-Lake, Cave Spring in Beamsville and Weis/Vineland Estates in Vineland began planting vinifera grapes. Viticulture practices have evolved and vinifera varietals are doing well. Conventional wisdom has been proven wrong.

By 2019, Ontario had 17,000 acres in grapes for wine and 180 wineries. Vineyards were planted in roughly 40% hybrids and 60% vinifera. VQA includes both Vinifera and Hybrids. Ontario VQA wineries sold 2 million cases of VQA wine at an average net price of $8 per bottle. That’s roughly $192 million per year in revenue from 17,000 acres.

In Oregon in 1970 there were 5 wineries and 35 acres of vines.

By 2016, Oregon had 30,500 acres of vineyards planted to almost 100% vinifera and 725 wineries. Over 30 years, significant capital investment flowed into the wine region centred in the Willamette Valley: Investment in land, vines, equipment, buildings and people. In 2016 Oregon wineries sold 3.4 million cases of wines at an average retail price of $30 per bottle. Roughly $US1.2 billion per year in revenue from 30,500 acres. And created an additional $US300 million annually in direct wine tourism spend.

Planting or re-planting a vineyard is an exercise in patience and having a long-term view on return on investment. It takes four years for a new vinifera vine to produce grapes. And it takes longer than that to get the best grapes from those vines.

Ontario Craft Wineries make great wine. Our pricing offerings range from value priced to ultra premium wines at higher price range. Ontario Craft Wines VQA wines are winning international acclaim and prestigious recognition. The prestigious Decanter International Wine Awards awarded over 300 medals to Ontario Craft Winery wines in 2020 alone. Our wines are consistently competing and winning against wines from everywhere in the world. And yet … We struggle to break through 10% domestic market share and we are barely present on the wine lists of GTA restaurants and hotels.

Oregon continues to see an inflow of capital investment in vineyards and wineries because there is an economic reason for doing so. In Ontario, we do not have an economically viable business model for attracting investment.

Oregon is a high cost of production area like Ontario. Labour rates are similar to Ontario. Land values are higher. Taxes across the board are lower in Oregon. Oregon wineries can sell and ship their wines anywhere in the U.S. Provincial Liquor Boards prevent the easy flow of shipments of wine from Ontario to other provinces. Oregon wineries can sell their wines directly to consumers anywhere in the U.S. and ship to the consumers anywhere in the U.S. They are now exporting a growing amount of their wines.

Oregon wineries can sell their wines at wholesale prices (based on volume purchases) directly to big box retailers or small independent wine shops in any state in the U.S. as they wish at whatever price the market and consumer dictates for their product. There is no State Liquor Store.

In Oregon wineries pay local municipal taxes at lower agricultural rates. Their buildings are taxed as farm buildings. In Ontario, small craft wineries that are located on agricultural land are taxed at commercial and industrial tax rates on their buildings.

The Direct-to-Consumer (DTC) channel now represents 10% of all wine sales in the U.S. and is growing at more than 10% per year. This is the channel with the highest profit margin for wineries. In the U.S., virtual wine brokers have entered the market to put selected offerings from different wineries in Direct-to-Consumer offerings. Ontario consumers are pre-conditioned to buy their alcohol from the LCBO. Buying direct from wineries in Ontario is a growing trend and this was accelerated with the COVID crisis, however, it still represents less than 1% of the 10% VQA of the total wine sold in Ontario. And Ontario Craft Wineries suffer from a lack of free inter-provincial trade.

Oregon does not produce high volume, low value bulk grapes on their premium land. They do not produce bulk wine for blending with imported wines to produce international/imported blends. They focus on Pinot Noir, Chardonnay and Pinot Gris as single vinifera varietals that grow well in their climate and soil and that produce wines that consumers love.

In Ontario the channels for Ontario Craft wineries to sell wine are constrained. The LCBO controls all channels for pricing, sales and distribution. The Canadian consumer has been fed a constant stream of advertising and marketing from well-funded international wine companies. Antiquated alcohol legislation and the retail environment favours the large incumbents and imported wines. And Ontario wines struggle to distance themselves from a consumer perception of low quality and high cost. After decades of LCBO advertising and marketing to favour imported wines, Ontario grown VQA wines have less than 10% market share in our local domestic market. Our market is dominated by large conglomerate-made international blends presented as local product and cheap imported bulk wines are dumped into our market. Imported wine production is subsidized in their countries of origin and heavily subsidized marketing efforts place them ahead of our products on the shelves of the LCBO.

Ontario Craft Wineries are under-represented on the wine lists of Ontario and the rest of Canada restaurants. The Oregon restaurant wine lists are dominated by Oregon wines. And U.S. restaurant wine lists are dominated by wines of California and Oregon and Washington State. In Oregon, the wineries can sell direct to the restaurants for a price that makes good business sense for both parties. The State government does not collect tax on that transaction. They do not take the margin on the sale – they are not involved. They get their tax at the sales tax level on the restaurant total bill. It is convenient and there is great incentive for the restaurants to put local wines on their list. And the consumer wins. In Ontario we cannot set the price we sell our wines to restaurants. The price is set by the rules and regulations of the LCBO price calculator and the provincial government adds a 6% tax on the VQA Ontario wines. Effectively, the restaurant pays LCBO retail prices for the wine, the winery pays additional taxes that imports do not have to pay and the consumer pays a higher price for a bottle of wine and then pays HST on their entire restaurant bill. Taxes on taxes on taxes.

As the year progressed, COVID-19 became the defining element of all of our lives in 2020. The Ontario Craft Wineries COVID Impact Poll found that between 60-80% of wineries reported a decrease in sales revenue between the months of April-July 2020 compared to the same months in 2019. 51% of wineries report a negative financial impact of $51,000 to $250,000 due to COVID. On average tasting room sales are down 56% and export sales are down 79%. These impacts and challenges are on top of the pre-existing condition of 48% of small wineries being unprofitable before the COVID era.

The LCBO remained open as essential service. Ontario Craft Wineries made the changes and investments to pivot to curb-side pickup and on-line ordering and direct to consumer delivery. Restaurant sales (30% of small wineries’ revenue) evaporated as restaurants were forced to close and accounts receivables with restaurants became bad debts.

“Buy Local” grew as a major trend. But the province and the LCBO blurred the edges on the marketing to consumers and the definition of a “local” product. The province “Made in Ontario” included imported wine blended with a small percentage of low value Ontario grape product put in bottles in Ontario. A slap in the face to our true local Ontario Craft Wineries.

Governments in wine producing regions around the world responded to the COVID crisis with programs designed to support their domestic producers and to encourage export … with Canada and Ontario specifically as one of their major target markets.

In November 2020, another budget was tabled with no material changes for our industry and no tax relief. Rules were changed to allow restaurants to sell wine for take away. And wine shops popped up in restaurant storefronts in the GTA stocked with imported wines. Our local restaurants in the wine regions of Niagara, Prince Edward County and Lake Erie North Shore instead proudly stocked and supported local craft wineries.

We entered the year 2020 with hope that the Ford Government would finally make the changes necessary to help our industry survive and grow.

But it has not happened.

We are at a fork in the road for our industry. The way forward has a path to success that will bring growth and economic prosperity to the rural communities in which we have invested and in which we work and live. The other path is the path we are currently on. No change. No change in an ever-changing market is really a move backwards. If you are treading water in a swift moving river, you will be carried downstream with the current. Our industry will stagnate and some parts of it may die. It is unfathomable to our members why this government has not made any moves to enable a path forward for our success. And this government continues to support the status quo with major market advantages provided to large incumbents and imports. We continue to be shackled by our past. It is time to create a new Ontario Craft Wine industry framework for success for the 21st Century.

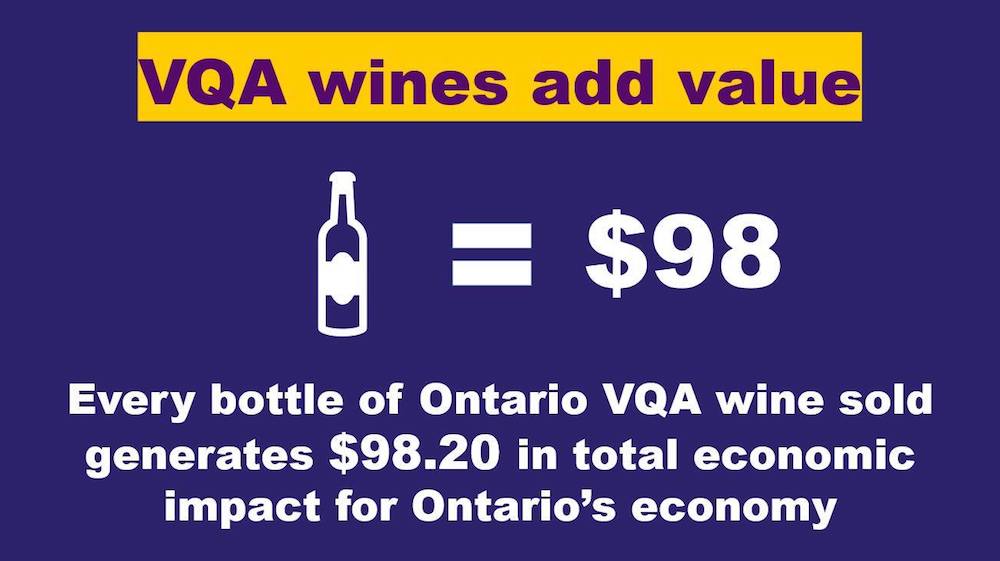

Ontario Craft Wineries are all farmers first. We are united in our passion to produce fantastic wines. We have invested our money and our blood, sweat and tears in our vineyards, our products, equipment, operations, buildings and our people. We have invested in Ontario. We have created business ecosystems that have 10 times the spin off economic value on each bottle of wine that we sell. And all we are asking for is that the government get out of our way.

2020 will be remembered as the year COVID impacted every aspect of our lives. It has changed the way we think about everything.

2020 in the vineyards of Ontario was an exceptional year. Perhaps the best of the century. Perhaps the best vintage we have ever produced. The quality of the grapes was outstanding. We have more talented winemakers working with this exceptional fruit than ever before. The wine will be superb. Likely the best wines our region has ever produced. These 2020 wines will begin to reach the market this spring and continue to be released over the next few years as they are ready. Please buy them direct from the wineries. Please ask for 100% grown Ontario wines in your restaurants when they re-open and demand that your local LCBO place Ontario Craft Winery products in a place of honour on their shelves. And lastly, please tell your local MPP that the Ontario Craft Wineries have earned and deserve the respect and support of the Ontario government.

We start 2021 again with hope. Hope that this government will make the changes necessary to secure our success and unleash our potential. We can help to re-build our Ontario economy as we recover from the effects of the COVID epidemic.

Hopefully 2021 is our year.

Note: Carolyn Hurst was approached by Wines In Niagara to offer her thoughts on behalf of the Ontario Craft Wineries Association on the state of the industry as we head into 2021. She is also co-owner of Westcott Vineyards with her husband Grant Westcott.

About the OCW

The OCW leads the growth and profitability of Ontario’s respected VQA wine sector – through strategic partnerships and authoritative trusted advocacy. The OCW represents more than 100 farm family wineries throughout the Province. These wineries are independently owned, small and medium-sized enterprises, dedicated to crafting 100% Ontario VQA wines. As grape growers, manufacturers and leaders in tourism, our winery members are located in the three designated viticultural appellations: Niagara, Prince Edward County and Lake Erie North Shore – including Pelee Island, as well as emerging wine producing regions such as Ontario’s South Coast, Georgian Bay and Grey County.

OCW members are the future of Ontario’s wine industry, representing a source of new investment, jobs and award winning wines to the province. Economically, Ontario’s VQA wine and grape industry contributes business revenue of $1.9 billion and generates an additional $236 million in tax revenues and $528 million in wages. This represents an annual economic impact of over $2.4 billion. Currently, more than 11,000 jobs are created in Ontario as a result of the wine and grape industry (100% Canadian). Further, the wine and grape industry has developed a loyal tourist following, welcoming over 2.4 million visitors annually (pre-COVID-19). This provides numerous spin-off benefits in the hospitality, tourism and agriculture sectors, which helps support other small businesses across our province.

Without a tax break,This area in Niagara which took 50 years to turn into a tourist champion from an industrial collapse ,also taxed and governed to death Our government should take note and not let history repeat itself.Our ontario and federal government needs to stop killing our local economy.

My heart is broken after reading this article, I visit the Niagara wine country all the time and since this covid madness I can see how this industry is bleeding badly and I have a feeling if the business will not open soon there will be a disaster , best regards

I have long been worried about our wine industry—–especially seeing how many wineries are up for sale due to an inability to cope with restrictions imposed by the Ontario government. This present government is no different. After reading this article my anxiety has increased many fold. This is not fair. The Ontario Wine Industry has had to compete with many other products both foreign and domestic. the old adage of “in order to make a million dollars in the wine Ontario industry, one must start with two million!

This is a losing proposition!

The delights of trying to produce quality wine in Ontari-ari-ario.

Major factor is that the LCBO is a major revenue source for the provincial government. They would be delighted if the local industry disappeared so that they could increase their monopoly position.

Personally, I only buy Ontario VQA wines and have since 1993. In that time the Ontario VQA wines have become more then world class and offer great value for what they are. The problem as I see it is the general public(I know this is a generalization) is of the mind that Ontario VQA wines are over priced and under deliver in quality. I have often said the the customer expects Toro Bravo prices with Napa quality. That you will get no where in the world. While I am finding the acceptance of Ontario VQA is growing, it is happening way to slow. But consider this. Even with all the taxes and levees put on Ontario wines, when comparing apples to apples many Ontario VQA wines when compared to imports of similar quality, the Ontario VQAs are of similar price or even less then the imports. But again it is trying to convince the public to even try an Ontario VQA product. This has been a soap box I have been on for a number of years, but sadly falls on deaf ears all to often. Even foreign wine writers such as Matt Kramer (Wine Spectator) and the now late Steven Spurrier (1976 Judgement in Paris and Bottle Shock)to name just 2 of many, praise Ontario VQA wines. Even calling Niagara a hidden gem of the wine world. The wineries are fighting with both hands tied behind their backs and yet produce so many amazing products and great value when compared again to like imports. Ok, I will get off my soapbox, but I could go on for many pages. I personally know many of these producers and think highly of them and what they produce. I really want to see them succeed here at home and it would not take much for that if the wine drinking public would only help by putting some VQA wine into their mix of wines.